Transient Leisure Demand Provides Renewed Opportunities for Growth

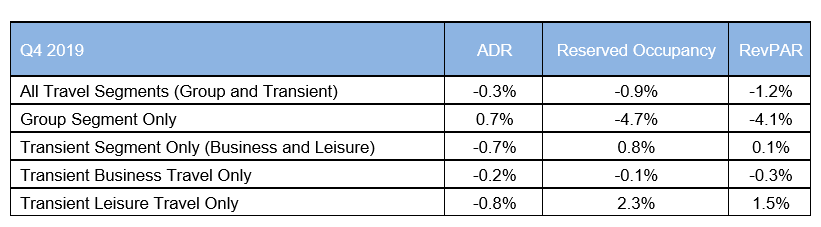

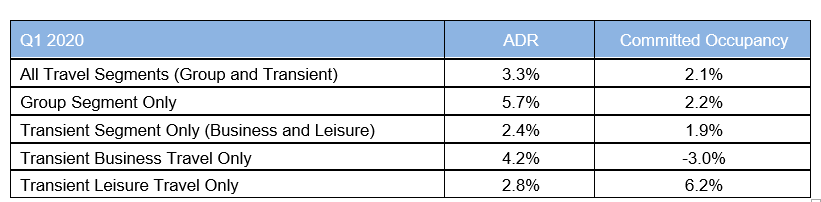

NEW YORK – October 30, 2019 – TravelClick, an Amadeus company, today released new data from the company’s October North American Hospitality Review (NAHR). According to the data, committed occupancy for the fourth quarter of 2019 through the third quarter of 2020 is up 2.2% compared to a year ago. Average daily rate (ADR) is down -0.3% based on reservations currently on the books for 2019. Group ADR is up 0.7%, while transient segment ADR is down -0.7% compared to the previous year. Transient business and transient leisure ADR are down -0.2% and -0.8% respectively.

Additionally, 18 of the top 25 North American markets are showing an increase in bookings compared to one month ago. Group sales continue to rise through the end of 2019, with the first and second quarter of 2020 increasing 2.2% and 5.5% respectively.

“The twelve-month outlook for North American hoteliers continues to stabilize and provide opportunities for growth, particularly within the leisure transient segment. This is a relatively new development that may deliver a welcome stimulus for increasing occupancy forecasts throughout the third quarter of 2020,” explains John Hach, Senior Industry Analyst, TravelClick.

Twelve-Month Outlook (Q4 2019 – Q3 2020)

For the next 12 months (October 2019 – September 2020), transient bookings are up 0.9 percent year-over-year, and ADR for this segment is flat at 0.0% compared to the previous year. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 3.1% in bookings, and ADR increased by 0.1%. Additionally, the transient business (negotiated and retail) segment is down 0.7% in bookings but up 0.5% in ADR. Lastly, group bookings are up 2.9% in committed room nights* over the same time last year, and ADR is up 1.5%.

“While the first quarter data for 2020 indicates renewed occupancy growth, there are concurrent metrics, most notably ADR, requiring continued vigilance, especially pertaining to the price/value relationship of hotel rooms to alternative lodging options,” adds Hach. “It’s becoming more important than ever for hoteliers to invest in business intelligence solutions to actively monitor new non-traditional competitors capable of disruption within their local markets.”

The October NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by October 1, 2019 for the period of October 2019 – September 2020.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The third quarter combines historical data (September) and forward-looking data (October – December).

###

About TravelClick, an Amadeus Company

TravelClick offers innovative, cloud-based and data-driven solutions for hotels around the globe to maximize revenue. TravelClick enables over 25,000 customers to drive better business decisions and know, acquire, convert and retain guests. The Company’s interconnected suite of solutions includes Business Intelligence, Reservations & Booking Engine, Media, Web & Video and Guest Management. As a trusted hotel partner with more than 30 years of industry experience, TravelClick operates in 176 countries, with local experts in 39 countries and 14 offices in New York, Atlanta, Barcelona, Bucharest, Chicago, Dallas, Dubai, Hong Kong, Melbourne, Orlando, Ottawa, Paris, Shanghai and Singapore. The Company also provides its hotel customers with access to a global network of over 600 travel-focused partners. Follow TravelClick on Facebook, Twitter and LinkedIn.

Media Contacts

Amadeus US press office: Grayling Communications

amadeus.US@grayling.com