Originally published on PhocusWire

Discover the latest travel and hotel booking trends and how to navigate them with confidence

Globally, the hotel industry should be enjoying the height of the summer tourist season. Instead, COVID-19 is impacting tourism numbers like we’ve never seen before – government lockdowns, border closures, and reduced airline schedules have all played a role in affecting people’s decision to travel.

Although travel is not yet returning on a global level, hotel occupancy is on the rise post-lockdown in many domestic and drive markets. However, conventional summer hot spots (beaches, theme parks, world-famous cities, etc.) are being avoided in favor of more rural locations, as outdoor recreation has grown in popularity to allow for social distancing.

As more countries begin to reopen, what does travel look like? What are the new guest expectations that hoteliers should be aware of to incorporate into their business strategies? What are the latest data and booking trends telling us about industry recovery? Here are 5 major areas of consideration for summer travel.

#1. Expect occupancy to change – often

In the age of COVID-19, historical trends no longer apply as hotel occupancy and revenue can change week-to-week. A decline in group, corporate, and international travel paired with the rise of local last-minute getaways makes it imperative for hoteliers to have access to comprehensive, forward-looking data to truly understand local market performance and plan for recovery.

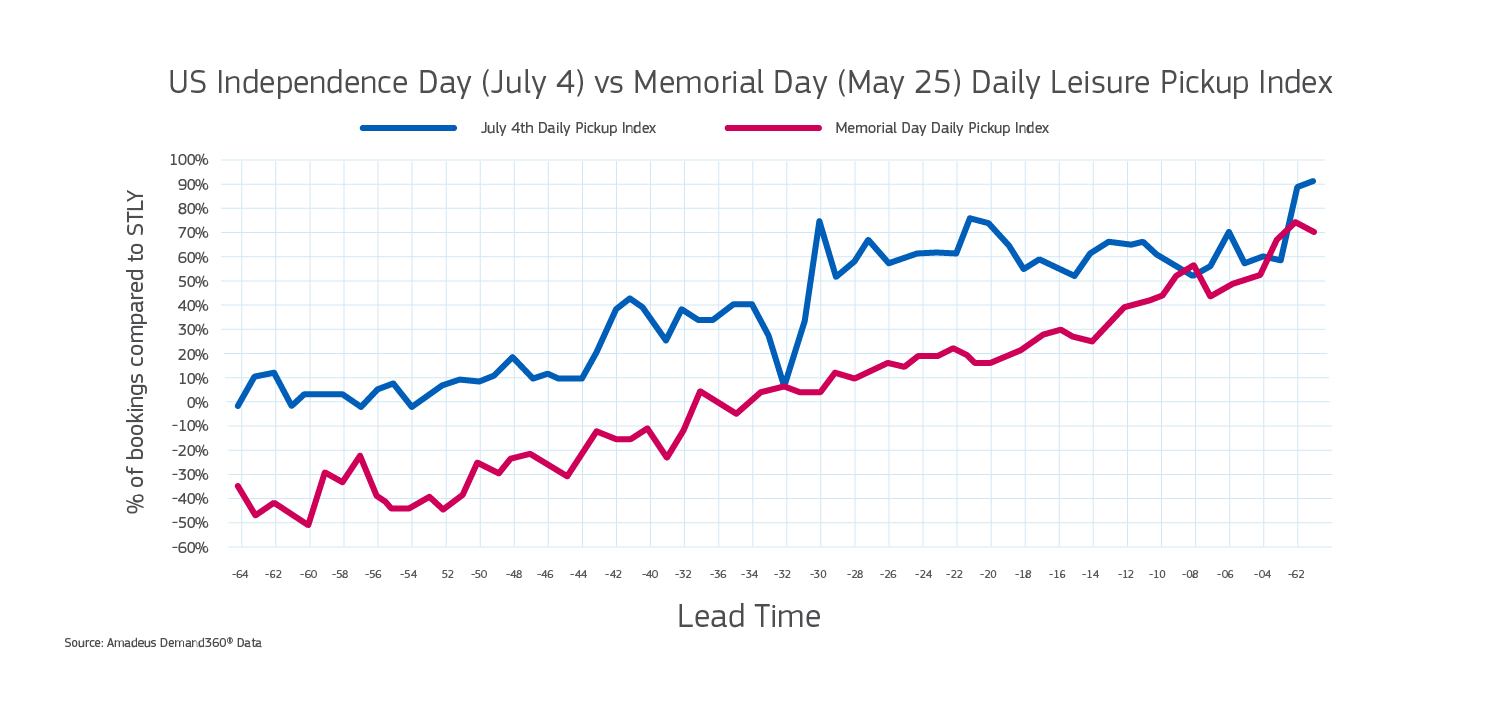

For example, US data from Amadeus’ Demand360® solution shows the difference in consumer confidence to travel over the Memorial Day (May 25) holiday compared to Independence Day (July 4) holiday.

“May was very different from July, and as we get away from summer and into the fall, bookings are going to change even more,” says Katie Moro, VP, Data Partnerships, Hospitality, Amadeus. “As consumer confidence fluctuates with states moving in and out of phased recovery, relying on data from last week or last year to drive a future revenue strategy will not be beneficial. Because of COVID-19, there is no time in history we can compare to what’s happening in the industry now.”

Just around the corner lies one of the most nerve wracking days of the entire year for US hoteliers – the Tuesday after Labor Day (September 8). “Historically, this is the window where leisure travel drops off as people return to school and work from summer holidays,” explains Moro. “Hotels again rely on group and corporate travel, but given government regulations on social gatherings and events, these types of bookings have not yet returned. So where will the business be? Who is traveling? It can feel overwhelming, but forward-looking data can provide guidance on how to plan the next steps.”

#2. The booking window is shrinking

Perhaps the biggest change happening in the hotel industry since lockdown is to the booking window. Typically, Demand360® data shows the booking window anywhere from 0-28 days, with resorts and other destination locations farther out. But now, for revenue professionals monitoring changes to the business 90 days out, it can be unnerving to see that today’s travelers are waiting until the last minute – 0-7 days prior to their trips – to make hotel reservations[AG1] .

This is due in large part to COVID-19 and may be hyper local in severity, based on government restrictions, infection rates, social distancing measures, and other factors. “This is the biggest change in the hotel industry compared to what we normally see,” says Moro. “Understanding traveler behavior has always been the cornerstone of an effective revenue strategy, but this latest trend puts even more pressure on the revenue leader to remain flexible, adaptive, and dedicated in their monitoring and response to what the data shows.”

#3. Use multiple booking channels to your advantage

The trickledown effect of the 0-7 day booking window can throw a revenue strategy into disarray if hoteliers don’t have a quick and effective response. But there are several ways to mitigate this and even turn it into an opportunity to drive demand.

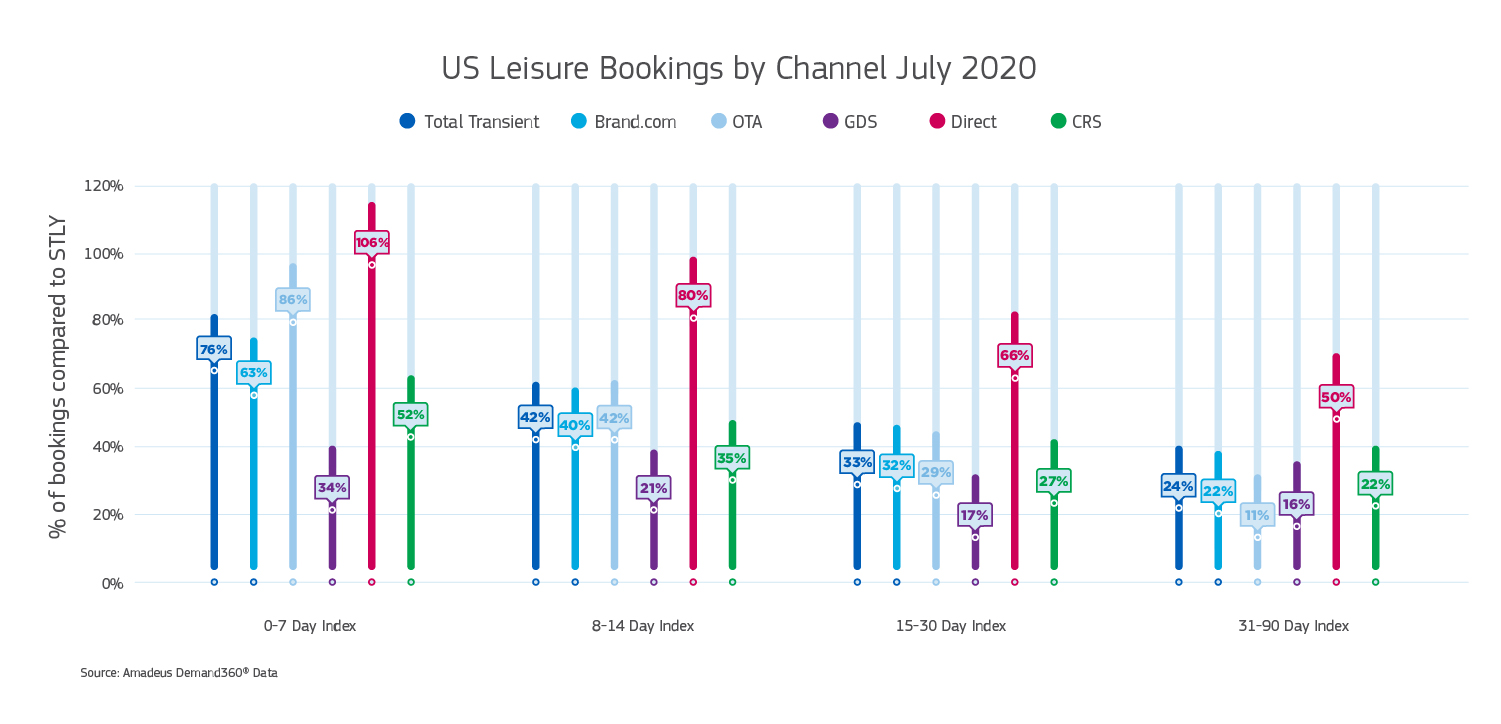

It’s up to hoteliers to maximize booking channels during their peak window in the consumer buying cycle. For example, you may want to increase staff to manage higher incoming call volumes in the 0-7 day booking window as direct bookings made on property are strongest in this period, though relevant in all booking windows. To boost reservations further out in the 8-30 day window, digital media campaigns can be highly effective in influencing bookings through Brand.com, as well as running promotions via online travel agencies (OTAs).

Amadeus’ Demand360® data provides these forward-looking insights, illustrating distribution trends by booking lead time windows. When comparing booking windows in the next 90 days to the same time last year, the highest volume is in the 0-7 day window, which suggests hoteliers should focus their campaigns on need periods further out.

The above data for the US reflects an increase in direct bookings over last year, demonstrating the need for appropriate staffing levels. Looking at total volume, OTAs are still driving the most business in the 0-7 booking window, while direct channels remain on top with more lead time. Why?

“People who are more nervous about traveling are taking the time to call the property directly and visit the website to find out more information,” Moro explains. “They are asking about cleanliness, amenities, and what to expect onsite. All of these questions can be addressed by making sure the latest information is up to date and easy to find on the hotel website. For people booking with just a few days’ notice, they’re likely less concerned and just need to find a place quickly with whatever inventory is left on an OTA.”

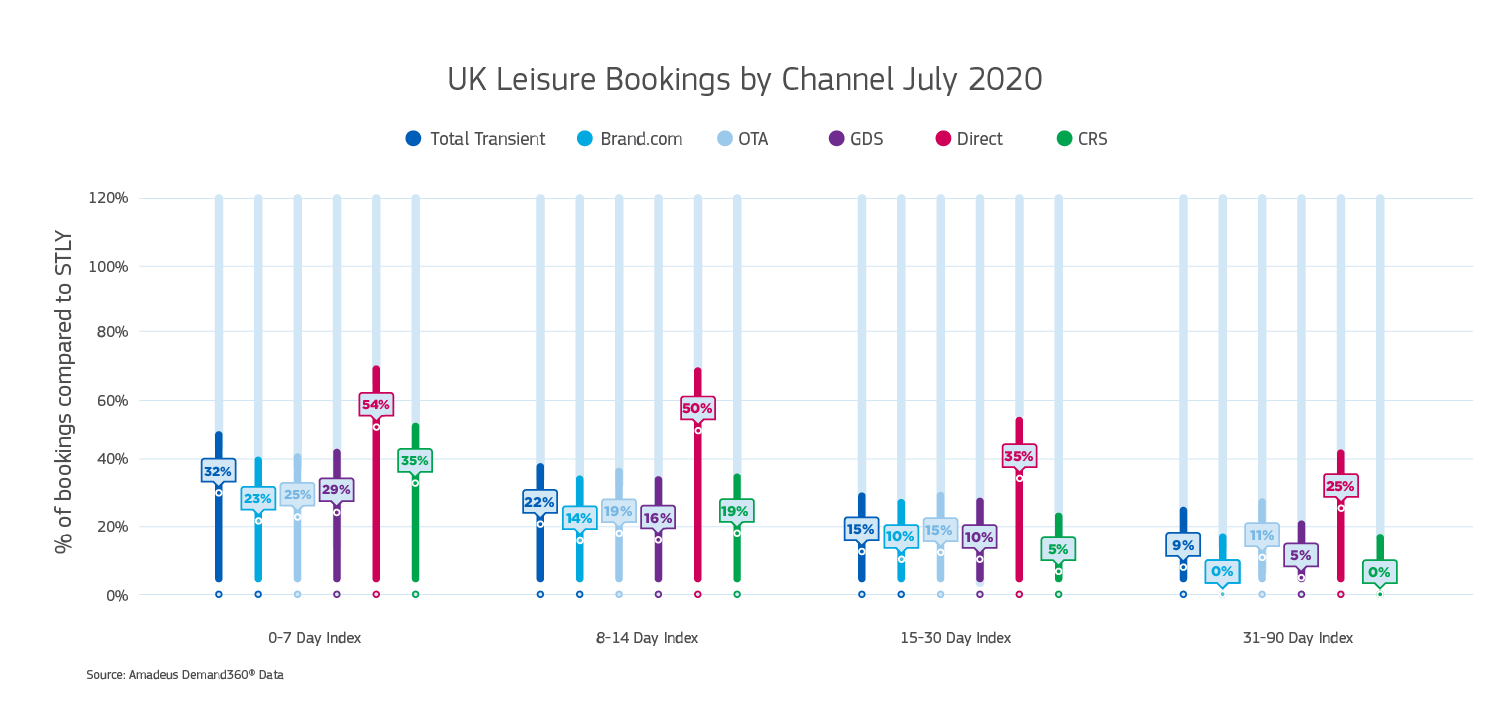

The picture is a bit different in the UK, where it’s more common to see travelers booking through a global distribution system (GDS) or using a travel agent to assist in their search. When analyzing channel performance across booking windows, the GDS is driving more volume than OTAs.

As a hotelier, make sure to keep your property’s operating information and safety protocols up to date so travel agents and consumers have the details they need to book with confidence across all channels.

#4. Protect your rates but consider value add-ons

When hotel occupancies are low, it’s common practice to deeply discount rates to fill rooms. However, with the 0-7 day booking window now popular in the COVID era, revenue professionals will have to rethink their approach to rates. Dropping rates consistently at the last minute can be dangerous, hurt a property or chain’s brand reputation, and take a long time to recover from. The practice doesn’t necessarily drive higher occupancy and it changes the expectations of the customer on what future room rates may look like. Instead, hotels in the UK should be driving rates for the Summer Bank Holiday (August 31) in the 0-7 booking window. The same can be said for beachfront hotels in Nice, France for the Assumption of Mary (August 15). It’s the responsibility of the revenue team to monitor demand for potential peak periods.

”The practice of increasing rates as the arrival date nears is now more important than ever as cancellation policies have been relaxed, and customers have the ability to cancel and rebook at low rates,” advises Moro. “Instead, stay true to your value proposition, and add in value incentives like free parking, a late check-out, or a welcome drink that you can take away later once business has improved.”

#5. Approach COVID-19 marketing like a new hotel opening

Hotels cater to different types of guests, but right now, leisure is the only major segment booking during COVID-19. If a property’s primary audience is corporate or convention business, it’s critical to consider marketing to new types of audiences to bring in revenue.

Treat your sales and marketing strategy like a new hotel opening. “You have to figure out the types of people who are traveling now,” says Moro. “Are they families? Outdoor enthusiasts? Spa and luxury seekers? Find out what’s important to them and tailor your marketing and sales strategy around it. It may require you to change your competitive set entirely. Instead of highlighting boardrooms to corporate groups, you may want to highlight amenities like your pool or your award-winning restaurant with craft beers on tap. Get creative to capture demand.”

To remain confident during crisis recovery, consider investing in technology that will provide more clarity and enable better business decisions in your market. In the examples provided above, booking windows and channel performance varies from the US to the UK and even across markets within these regions. Navigating COVID-19 will require patience and adaptability but having forward-looking data specific to your area will provide insight into what your competitive set is doing, and where and how people are booking your property.

For even more information on how to prepare your hotel’s recovery strategy for revenue management, sales, operations, or marketing, download our eBook series, “Planning for Hospitality Recovery.”