By: Katie Moro, Vice President, Data Partnerships, Hospitality, Amadeus

In a recent article published in partnership with HSMAI, we reviewed metrics related to occupancy changes, segment shifts, and rate adjustments to help you understand critical insights on your continued path to recovery. We outlined net reservation trends as COVID-19 cases fluctuate by states and markets as well as the challenge of using occupancy as the sole metric to success. In this blog, we are sharing our findings based on a deep dive into US booking activity over the past five weeks.

In previous articles, we have shared context that the booking lead time has shortened to 0-7 days before arrival, and average daily rates (ADR) have declined between $50 – $60 in June and July. Understanding this context, we wanted to explore two additional areas that impact ADR – price position and mix of business.

Price position

There is no question that the impact of COVID-19 on hospitality has been severe. Where hoteliers would have traditionally looked to group and corporate business as a strong base, they are instead experiencing a significant decrease in these segments. This shift makes optimizing business mix and establishing rates challenging as demand is not exceeding supply. In response, there has been a negative impact on the published retail rates offered and booked by domestic travelers wanting and willing to travel.

The performance data from historical global events tells us that hoteliers should hold their rate since significantly dropping ADR results in a more extended recovery period. The opposing view of this argument suggests that hoteliers are desperate to capture any available demand to sustain their business. These are two compelling arguments, and honestly, I find myself on both sides, depending on the day.

The general practice in revenue management is that your retail price position drives almost every other rate within your hotel. Understanding this and acknowledging a hotelier’s desire to capture demand, we looked deeper into the data to understand if there is a correlation between two scenarios:

- As markets lower rates, do they see a corresponding increase in occupancy?

- If they maintain rates (in a few cases, raising rates), are they losing occupancy?

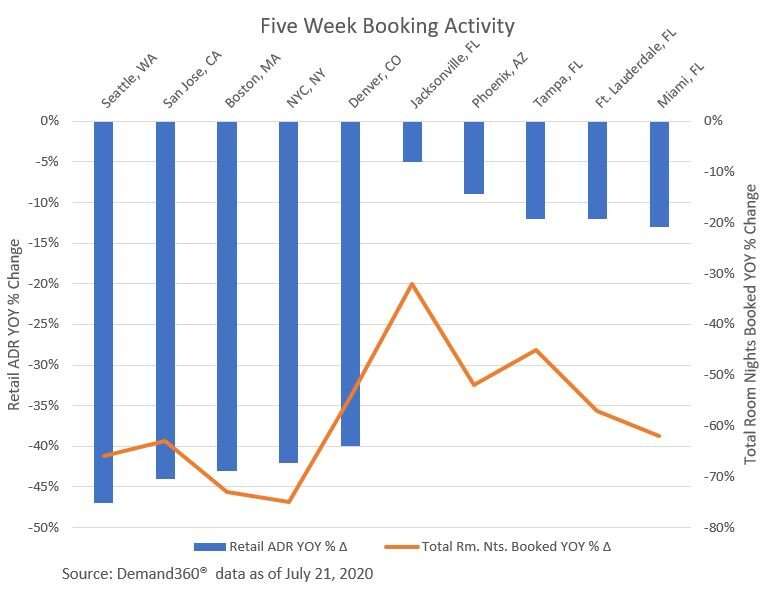

To answer these questions, we reviewed the past five weeks’ booking activity for ten major markets.

Our findings show that markets such as Jacksonville, FL and Tampa, FL as well as Phoenix, AZ had the lowest year over year decline in retail ADR, while also seeing the smallest drop in room nights booked. As opposed to Seattle, WA, San Jose, CA, and Boston, MA, all of which have seen the greatest decline in retail ADR and total occupancy. So, as it relates to the current recovery cycle, you might find that in your market, the argument that lowering your rate does not increase demand wins this round.

Mix of Business

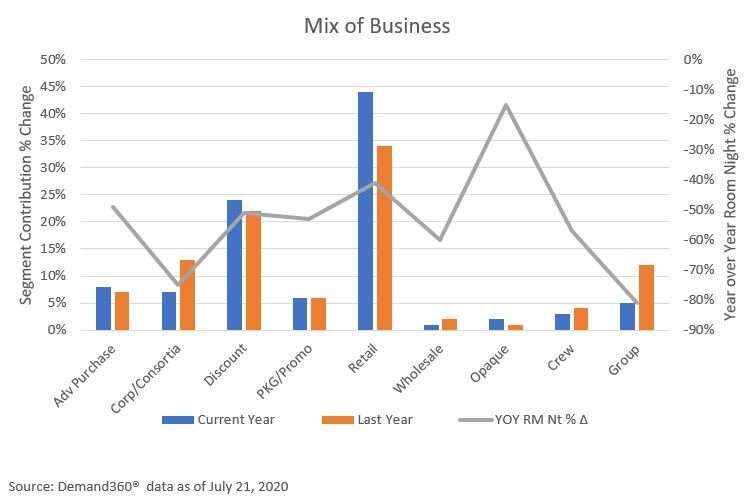

We established at the outset that recovery is about more than rate. We also looked at segment performance and impact on recovery. The five-week booking activity in the US shows the performance of most segments declining when compared to the same time last year. An exception to this trend is the retail segment experiencing a 10% contribution increase. In traditional times, this would be encouraging as retail typically drives a higher overall ADR and greater profitability.

However, if you examine the year over year percent change in room night production, you may be surprised to see that the Opaque segment contribution has increased a percentage point and experienced the smallest year over year decline in room nights booked. This channel is typically used to drive last-minute, lower rate bookings. We previously considered that travelers are booking in very short booking windows. So, while Opaque’s overall contribution to the total rooms sold is currently low, hoteliers should consider how and when they’re using this channel as it is typically the least profitable segment.

Remember, this recovery cycle is truly shaping up to look very different than any we’ve experienced in the past. Hoteliers must use comprehensive, forward-looking data to build an actionable plan to come back stronger than ever. Remember to hold tight when establishing segments and pricing strategies to position the industry for a swift and profitable recovery.

For additional insight into hotel revenue management best practices during a crisis, download our eBook, “Planning for Hospitality Recovery.”